Legal Ramifications and Judicial Conclusion

The years-long pursuit of Qian was not a single, swift action but a protracted cat-and-mouse game, initiated years before the final 2024 arrest. The foundation of the entire case was laid by observing how the fraudsters attempted to reintroduce their illicit capital back into the above-ground economy.

The Initial Suspicion Triggering Increased Scrutiny

The net of suspicion began to tighten around Qian and her network not through a direct tip-off about her hiding spot, but through highly conspicuous, almost arrogant, attempts to inject their capital back into the legitimate, high-value real estate market. Authorities became acutely alert when Qian and her associates made concerted, publicized efforts to purchase two separate, exceptionally high-value luxury properties in London.

Consider the audacity: a prime property near the affluent Hampstead High Street, valued near £24 million, and a mansion in the Totteridge area carrying a price tag of £12.5 million. These overt, large-scale transactions—especially after she had arrived in the UK under a false identity—served as an immediate red flag. This kind of high-profile spending, when juxtaposed with a lack of a legitimate, transparent income stream, always prompts scrutiny. These attempts served as the initial beacons that brought the vast network under the microscope, leading directly to the earlier arrests within the peripheral support structure.. Find out more about Crypto Queen arrest location York Airbnb.

The Previous Encounter and Early Deception Attempt

To truly understand the final York capture, one must remember the dress rehearsal that took place years earlier. Even before the final, successful detention, there was a prior, telling interaction with law enforcement that demonstrated Qian’s deep-seated, habitual evasion tactics. During an earlier raid, reported to have occurred on October 31, 2018, authorities located Qian.

In that instance, she was found in bed, reportedly beneath a distinctive purple bedspread. Her reaction? The exact blueprint she would use years later: she deployed the same tactic of claiming a false identity—this time stating she was “Yadi Zhang”—and fabricating a narrative of suffering from significant, serious brain and leg injuries. This historical incident was not just a footnote; it was a behavioral blueprint. It proved the consistency of her desperate measures when cornered, illustrating that for some, deceit becomes the default response to crisis.

The Final Sentencing and Accountability for the Architect. Find out more about Crypto Queen arrest location York Airbnb guide.

Following her apprehension, the years of complex legal proceedings finally reached their conclusion in a London court. Zhimin Qian, the architect of the monumental Ponzi scheme, finally faced the full weight of the consequences of her actions. On Tuesday, November 11, 2025, she was formally sentenced to a lengthy term of imprisonment.

Qian received a jail sentence of eleven years and eight months for her central role in the multi-billion-pound fraud. Judge Sally-Ann Hales stated that Qian’s motive was one of “pure greed” and that her crimes were so serious that only a “lengthy and immediate” custodial sentence was appropriate.

This sentence acknowledged the gravity of the offense, the vast number of victims—over 128,000 across China—and the sheer audacity of her protracted evasion. It marked the judicial conclusion of one of the most notorious financial crime sagas in recent British history. For insights into sentencing guidelines for complex financial fraud sentencing in the UK, see our analysis.

The Shifting Sands of Cryptocurrency Regulation and Trust. Find out more about Crypto Queen arrest location York Airbnb tips.

Beyond the courtroom drama and the historic seizure, the Qian case is a landmark not just for police, but for global finance. It’s a harsh, seven-year-long object lesson in what happens when global technology outpaces global governance.

International Cooperation in Cross-Border Fugitive Recovery

This case stands as a significant achievement in the realm of international law enforcement cooperation, particularly concerning financial crime that deliberately exploits the gaps between jurisdictions. The investigation involved an unprecedented level of collaboration between British authorities—including the Metropolitan Police and the National Crime Agency—and law enforcement agencies in China.

The successful tracking, arrest, and subsequent sentencing sends a powerful signal. It highlights a growing capacity and, more importantly, a willingness among nations to jointly pursue fugitives who attempt to hide massive digital wealth across borders. This signals a more robust future for transnational crime fighting, moving beyond slow extradition treaties toward more agile, intelligence-led collaboration.

The Development of Victim Compensation Frameworks. Find out more about Crypto Queen arrest location York Airbnb strategies.

A crucial, and ongoing, aspect of this saga—one that continues even after the architect’s sentencing—involves the complex and sensitive process of seeking restitution for the tens of thousands of defrauded investors. British authorities have actively worked to establish and refine a compensation scheme designed to allow the victims, many of whom are based in China, to potentially recover some portion of their lost investments.

However, this is where the very nature of the crime introduces a final layer of financial uncertainty. The ultimate success of the compensation scheme is now directly tied to the market performance of the recovered Bitcoin. If the price of Bitcoin soars between now and the final distribution order, the victims benefit; if it crashes, their relief is diminished. Their financial outcome is tethered to the volatile winds of the cryptocurrency market itself.

Implications for the Future of Digital Asset Oversight

The entire affair—from the initial rapid accumulation of billions through a crypto-masked scheme to the historic nature of the seizure—serves as a profound case study and a stark warning for the global financial sector. It screams of the critical need for enhanced regulatory frameworks designed specifically to oversee digital asset investment platforms and, more importantly, to protect retail investors from scams utilizing the allure of new technology.. Find out more about Crypto Queen arrest location York Airbnb overview.

The case has undoubtedly influenced ongoing discussions globally regarding the necessary safeguards to prevent future catastrophic losses stemming from Ponzi schemes masked by the veneer of decentralized finance and cryptocurrency innovation. The key takeaway for everyday investors? Due diligence is paramount, especially when promised returns sound too good to be true. If you’re looking into digital assets, always check the safeguards; look at our guide on assessing cryptocurrency investment risk before committing funds.

The Enduring Media Narrative and Public Interest

The story of the “Crypto Queen” captured the sustained attention of media outlets across the spectrum precisely because it embodies a classic narrative: hubris meeting inevitable downfall, set against the backdrop of modern digital finance. Six years on the run, multiple aliases, luxury living, and a dramatic capture in a common rental property—it’s television drama condensed into a true-crime reality.

This ongoing public interest ensures that the details of the fraud, the execution of the recovery, and the final judicial outcome remain relevant, serving as a continuous cautionary tale in both financial crime reporting and general true-crime circles well into the future. The developments in this sector are indeed worth following, as they are setting the legal and enforcement precedents for handling next-generation financial criminality. We must remember that while the technology evolves, the human element—greed, deception, and the pursuit of justice—remains constant.. Find out more about Largest single cryptocurrency confiscation UK history definition guide.

Key Takeaways and Actionable Insights for Today’s Investor

The saga of Zhimin Qian is over, but the lessons remain fresh as of November 2025. While you aren’t running a multi-billion-dollar Ponzi scheme, you are an investor navigating a complex financial world. Here are your actionable takeaways from the fall of the “Crypto Queen”:

- The Physical Failsafe: Even the most advanced digital schemes rely on a physical key. Never store critical access information (passwords, private keys) only digitally. Use strong, encrypted password managers and consider robust, physical paper backups stored securely—but never directly with the device.

- The Red Flag of “Guaranteed” Returns: Qian promised up to 300% returns. Any investment promising extraordinary, guaranteed returns with little apparent risk should be treated with extreme suspicion. The higher the promise, the deeper the due diligence must be. Consult reputable financial advice before diving into high-risk digital asset investing guidelines.

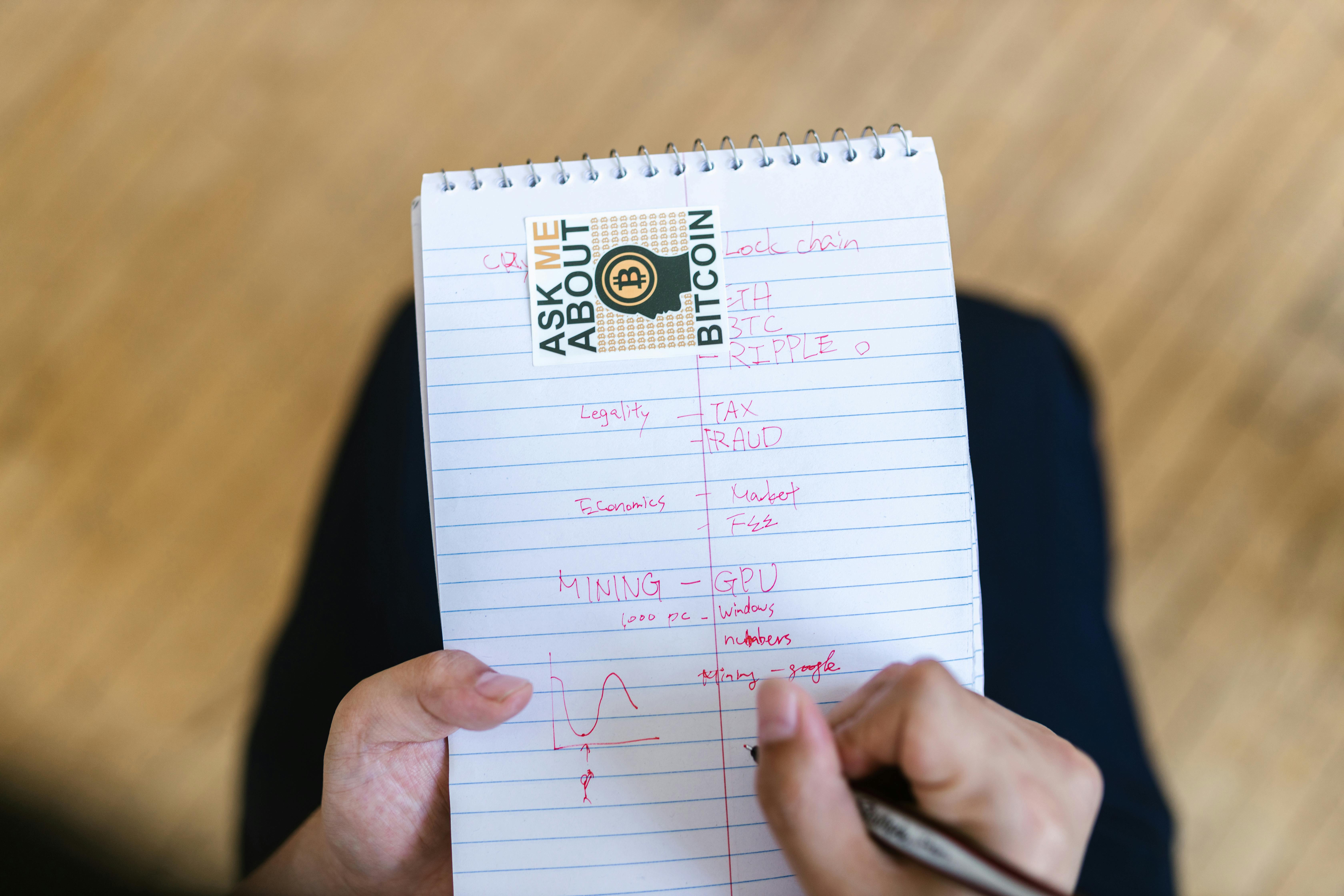

- Follow the Paper Trail (The Laundering): The case was cracked not by tracing Bitcoin across the blockchain, but by tracing the *real estate purchases* and *associate movements* back into the physical world. If an investment seems too opaque, ask where the profits are being materialized—luxury goods, property, shell companies? That’s where the law often finds its entry point.

- Surveillance on Support: Law enforcement spent years patiently monitoring the accomplices. As an investor, monitor the *team* behind the product, not just the CEO. Who are the key operatives? Are they experienced? Do they have clean records?

What are your thoughts on the role of international cooperation in tackling crypto-crime? Do you believe the victims will see fair compensation given the market volatility?

Share your perspective in the comments below—let’s keep the conversation on financial vigilance alive.