The Evolving Geography of Visitor Accommodation

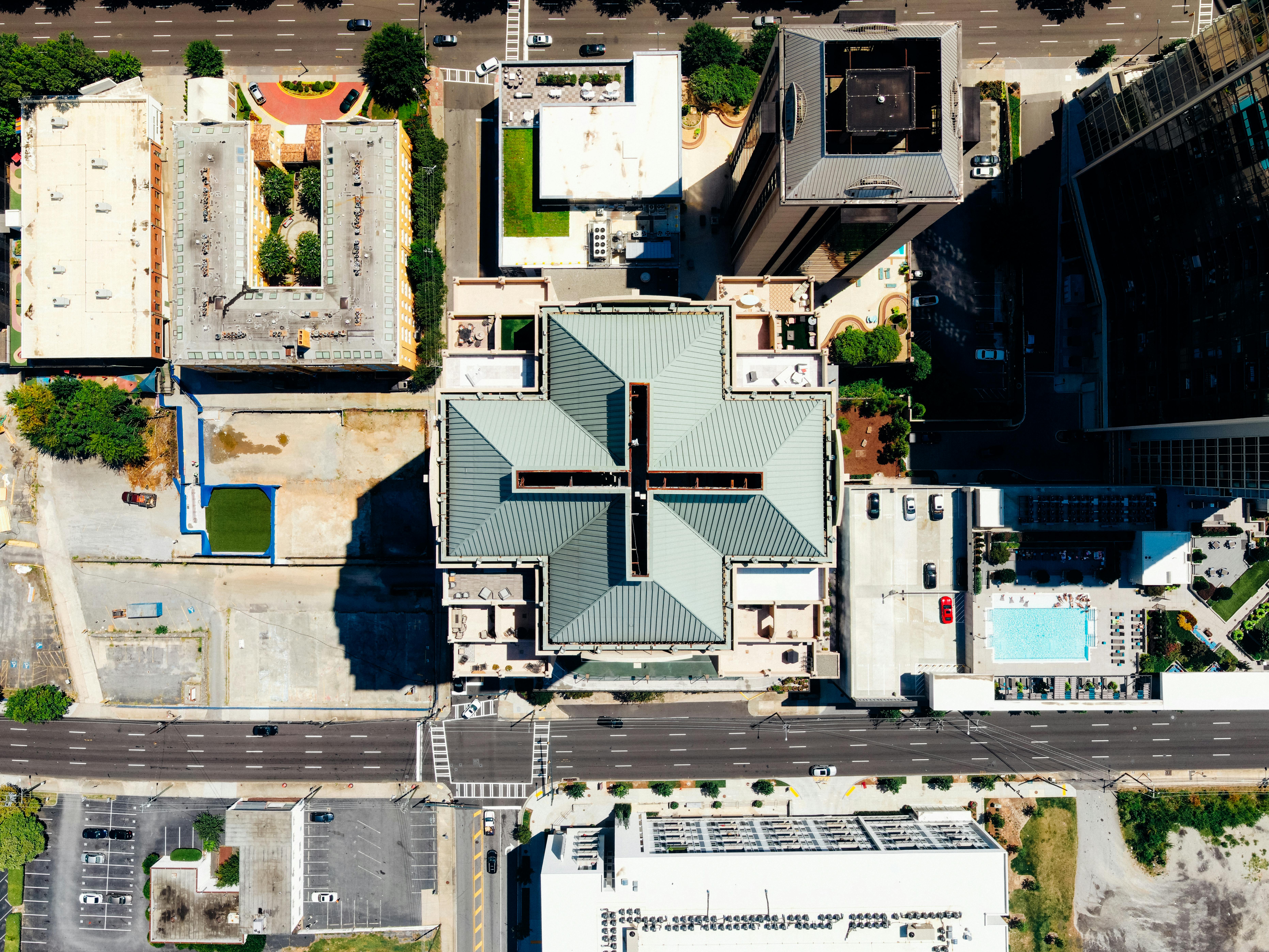

A significant shift defining the current short-term rental trend is how the available housing stock is distributed. Unlike traditional hospitality models that keep capacity concentrated in the downtown core, the decentralized nature of the short-term rental market inherently spreads lodging opportunities across a wider swath of the urban and suburban landscape. This dispersion offers a fundamentally different lens through which visitors can experience the city.

Shifting Preferences Away from Traditional Hotel Stays

As central business district hotels inevitably approach maximum capacity or list their rooms at peak premium rates, a substantial segment of the visiting population will logically pivot toward the short-term rental sector. This shift is often driven by a desire for a more personalized, spacious, or domestic living environment than what a standard hotel room provides for a multi-day international trip. The private rental offers a kitchen, separate living areas, and a necessary sense of rootedness in a neighborhood setting.

Exploring Unique Neighborhood Immersion Opportunities. Find out more about Atlanta short term rental bookings World Cup surge.

The decentralized nature of private rentals means that many visitors will be housed in areas far removed from downtown or well-known commercial centers like Buckhead. Reports confirm many of the rentals filling up are located outside these traditional tourism zones. For the traveler, this presents an exceptional, curated opportunity to explore Atlanta through a more authentic local lens. Imagine a guest staying near a local park, experiencing community life, and hearing the sounds of the neighborhood—a far cry from a high-rise hotel lobby. This offers a chance to experience the city’s diverse character beyond the typical tourist itinerary. You can read more about the role of these unique spaces in short-term rental experience design.

Supply Dynamics and Inventory Availability in the Metro Area

The operational reality of the short-term rental market is defined by its supply side—the sheer number of homes, apartments, and accessory dwelling units available for lease. Tracking this supply is complex, as the inventory is decentralized and often fluid, changing week-to-week based on owner decisions. However, current data compilations provide a solid baseline understanding of the existing capacity within the wider metro area.

Current Inventory Benchmarks and Tracking Methodologies

Market intelligence firms specializing in monitoring accommodation platforms have aggregated data indicating that the inventory within the Atlanta metropolitan statistical area currently consists of a substantial number of registered individual listings across the major booking platforms. This figure—which sits at over 20,000 individual listings as of late 2025—is the operational capacity being closely watched by both investors and city planners. The tracking methodologies employed by these firms are comprehensive, aiming to capture listings across all major sources.. Find out more about Early commitment private lodging Atlanta World Cup guide.

The Potential for Last-Minute Listing Additions

While the current inventory count is robust, it is not static. The intense pressure of impending high demand often incentivizes hesitant property owners to finalize their preparations and bring their units online. Market observers anticipate that the total number of listings could see a measurable increase as the tournament approaches. This influx of latecomers might include individuals or small-scale investors motivated primarily by the prospect of high-yield, short-term bookings over the tournament window, thereby slightly expanding the supply base to help absorb some of the intense, concentrated demand.

Regulatory Limbo: The Unresolved Governance of the Hosting Sector

A persistent undercurrent to the excitement surrounding this accommodations boom is the city of Atlanta’s long-standing, yet evolving, debate over how to effectively govern and regulate the short-term rental industry. For years, city leadership has grappled with implementing a cohesive policy framework that balances economic benefits with community concerns.

The Protracted Legislative Stalemate Within City Limits. Find out more about Short term rental host revenue projection Atlanta tournament tips.

The narrative of “stalemate” has recently given way to very specific, recent legislative action in late 2025. While many operators hoped a comprehensive overhaul would occur, the City Council recently delivered a split verdict on targeted areas. In a move that relieved many property owners, the Council narrowly rejected legislation aimed at banning new short-term rentals in the northeast districts, including parts of Buckhead and Brookhaven. This decision meant that current operators in those areas can be “grandfathered in” should future legislation pass.

However, in a different, highly localized vote, the Council approved a resolution banning new short-term rentals specifically in the Home Park neighborhood near Georgia Tech. This highlights the piecemeal approach the city is taking. Current Atlanta law still requires hosts to navigate a structured framework, including acquiring a Short-Term Rental License (STRL), which generally limits owners to two properties, one of which must be their primary residence. You can find more details on the current Atlanta, GA short-term rental laws and regulations for 2025.

Comparative Analysis of Neighboring Municipal Regulations

In stark contrast to Atlanta’s targeted, and sometimes delayed, deliberation, several surrounding municipalities have proactively stepped forward to establish and enforce specific ordinances governing short-term rentals. Jurisdictions such as Cobb County, Hall County, Smyrna, Brookhaven, and South Fulton have already enacted rules that vary in stringency. These regulations often impose clear limitations, such as caps on the total number of rental nights permitted per year or specific occupancy density ratios tied to square footage, offering a patchwork of operational standards across the region.

Proactive Regional Strategies: Jurisdictions Taking the Lead. Find out more about Atlanta World Cup lodging price inflation trends strategies.

While the central city navigates its regulatory quandary, surrounding county governments have recognized the immediate financial opportunity and the imperative to manage the lodging demand systematically. They are implementing targeted programs designed to channel visitor accommodation needs into their local residential bases while providing clear guidelines to participating homeowners.

Fayette County’s Novel Tax Incentive Framework

One notable example of regional initiative comes from Fayette County, which has elected to utilize a specific provision of the federal tax code, often referred to as the “Master’s Rule.” This framework empowers local homeowners to rent out their primary residences for a limited number of nights—up to fourteen per calendar year—without being subject to state or income tax on the earnings derived from those stays. County officials are actively promoting this as a means for residents to benefit directly from the visitor surge while augmenting the overall lodging capacity available.

The Role of Specialized Digital Housing Portals

To streamline the process for homeowners wishing to capitalize on this unique tax opportunity and ensure registered properties meet a basic standard for international guests, local governments like Fayette County have supported the establishment of dedicated digital resources. This specialized platform serves as a central nexus where interested property owners can formally register their homes. Upon registration, hosts receive a detailed preparatory checklist designed to ensure their dwelling meets necessary operational and amenity standards, effectively creating an organized pathway to event-linked revenue generation.. Find out more about Atlanta short term rental bookings World Cup surge overview.

The Downtown Rejuvenation Narrative and Temporary Commercial Use

The World Cup’s influence is extending far beyond residential accommodations and is beginning to catalyze activity in the commercial real estate sector, particularly within the South Downtown district. This area, characterized by a significant number of older buildings and underutilized parking assets that have been under a multi-year revitalization effort, is pivoting to leverage the short-term need created by the massive event.

Pivoting Commercial Real Estate Towards Transient Use

With the first major match now just months away, leadership in the South Downtown revitalization zone is actively seeking temporary tenants to occupy renovated spaces on a short-term lease basis, perhaps spanning only the summer of the tournament. This strategy is designed to generate immediate cash flow and activate spaces while long-term, permanent tenants are still being secured. The search is broad, targeting a diverse array of users, from emerging “cool brands” looking to stage unique hospitality experiences to larger corporate entities seeking a temporary physical presence to engage with the transient population. For those interested in the future of Atlanta’s commercial spaces, tracking the success of this strategy will be key to understanding Atlanta commercial real estate outlook.

The Pursuit of Immediate Activation for Underutilized Assets. Find out more about Early commitment private lodging Atlanta World Cup definition guide.

Specific commercial corridors, including sections along Broad Street that are being developed into a food and beverage nucleus, are being prioritized for these temporary placements. The explicit goal articulated by the district’s development team is to ensure that the downtown area presents its absolute best face to the world—to “shine and glisten with Atlanta’s best”—during the World Cup festivities. This push for immediate, short-duration commercial activation demonstrates how this major international event is accelerating development timelines and inspiring creative, flexible leasing models across the urban core to maximize visitor engagement and economic capture during this unique window of global attention.

Conclusion: Navigating the Short-Term Rental Tsunami

What we are witnessing in Atlanta’s private lodging market is more than just a predictable tourism uptick; it is a strategic preemptive strike by a global audience eager to secure their stay. The data from December 2025 is irrefutable: early commitment is the name of the game, pushing rates for remaining inventory toward a $300 per night average.

This phenomenon is generating a tremendous $70 million economic impact forecast, offering a significant financial opportunity for savvy residents to earn thousands over the tournament period. However, this boom exists within a complex regulatory environment where the City Council is making targeted, rather than sweeping, policy decisions, such as the recent ban in Home Park.

Actionable Takeaways for Hosts and Travelers:

- Hosts: If you are considering listing, the time for deliberation is over. Open your booking window now to secure the earliest, highest-intent travelers and maximize your potential earnings of $3,700+.

- Travelers: Assume the best inventory, especially in desirable neighborhoods outside the core, will be gone before the spring. Lock in your dates now, understanding that $300+ per night is the new baseline for premium access.

- Community Awareness: Pay close attention to specific neighborhood rules—Atlanta’s regulatory stance is evolving on a hyper-local basis, as seen with the Home Park decision.

The overall atmosphere in Atlanta is one of active, sometimes unconventional, preparation. Every available asset, residential or commercial, is being assessed for its potential to contribute to and profit from Atlanta’s forthcoming status as a temporary global epicenter for the world’s most popular sport. Are you ready to be part of the inventory that meets this unprecedented demand?